Full guidance for all your commercial real estate needs

Commercial Real Estate Services Worldwide

A team you can trust, always.

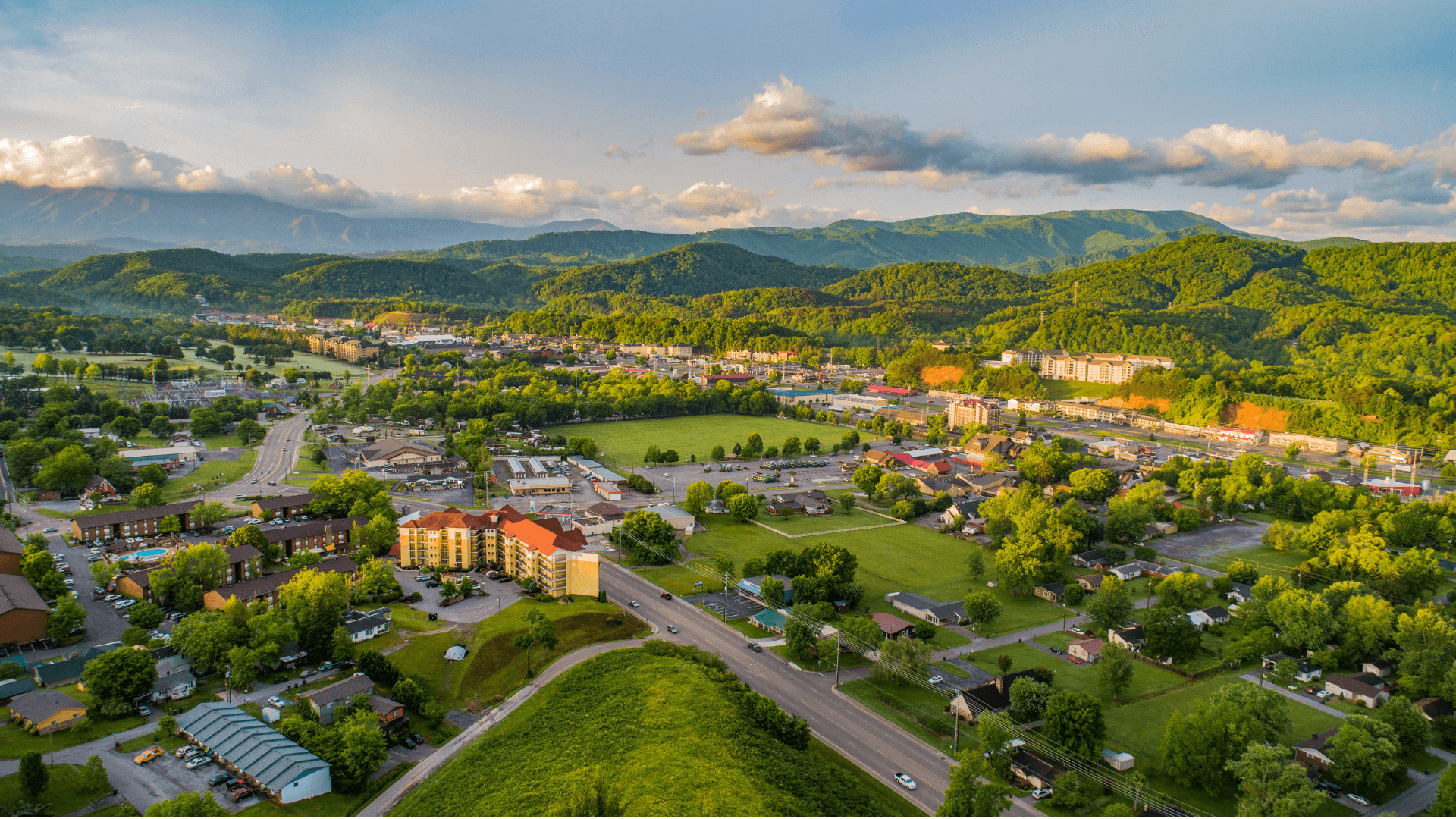

Providing full-service commercial real estate brokerage support to East Tennessee since 1983, Koella Moore has over 40 years in business as a leader in commerical real estate. We are a certified woman-owned & minority-owned organization of professionally trained brokers with international reach and local expertise.

40 Years

in Business

450 Years

Combined Broker Experience

40 Years

in Business

450 Years

Combined Broker Experience

Woman-Owned,

Minority-Owned

3.5 million

Square Feet of Properties Managed

Providing the best in Commercial Real Estate

Complete advice for all of your real estate needs

NAI Koella | RM Moore is the leader in Commercial Real Estate in Middle & East Tennessee, providing the largest and most comprehensive full-service commercial real estate brokerage support.

Receivership

Receivership

NAI’s Global Proven

Industry Expertise

NAI Global professionals, including NAI Koella | RM Moore, excel in delivering exceptional results for clients on both local and global scales. Their success is driven by their creativity, collaboration, and unwavering commitment to providing top-notch knowledge and service, a hallmark of Tennessee’s leading Commercial Real Estate service providers.

325+

Offices

65

Countries

5,800

Professionals

325+

Offices

65

Countries

5,800

Professionals

$20 Billion

Transaction Volume

$1.5 Billion

Total Gross Revenue

1.1 Billion SF

Property and Facility Managed

Want to see more of our featured listings?